State of eCommerce Platforms 2024

Isaiah Bollinger

Isaiah Bollinger

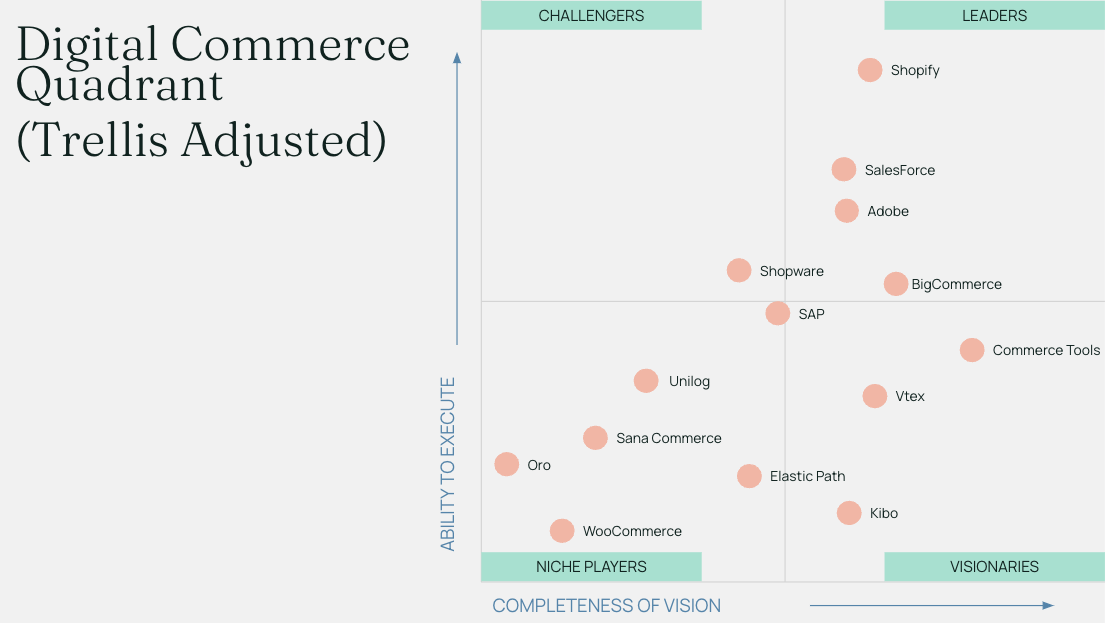

I took a stab at my own version of a platform landscape in visual graph format. It’s obvious to me that Shopify is by far the leader, and in the coming years, it will take more and more market share in the enterprise away from folks like Salesforce and maybe even Adobe and Commerce Tools.

Shopify & Shopify Plus

Shopify is winning the eCommerce market by a long shot right now. It is by far the most valuable eCommerce platform by GMV going through the platform, revenue, market cap, and total users.

They have achieved this for several reasons. One is their massive and growing user base of over 2 million stores. But more importantly, they have multiple customer revenue channels via eCommerce SaaS, payments, POS, and other products they have been developing.

Some of their recent highlights include:

- Expanded Features: Shopify has likely expanded its features to cater to the evolving needs of online businesses. This might include enhanced customization options, improved analytics tools, and more efficient fulfillment solutions. You can see this in more detail in their winter editions

- International Growth: Shopify’s international presence has likely grown, with an increasing number of merchants worldwide leveraging its platform. This expansion could involve partnerships with local payment providers, language support, and localized marketing tools.

- Omnichannel Integration: With the rise of omnichannel retail, Shopify has focused on integrating online and offline sales channels seamlessly. This involves enhancements to its POS (Point of Sale) system, enabling merchants to manage inventory and sales across multiple channels from a centralized platform.

Strengths:

- Theme marketplace

- Ease of use

- POS, Payments, and eCommerce platform all in one

- Large and robust app marketplace

- Easy to theme and get up and running

- Markets Pro is great for simple and fast international use cases

- Great developer and agency ecosystem

- Low cost of ownership and implementation as long as you fit within their constraints

Areas that need improvement:

We don’t see Shopify slowing down anytime soon, but we feel they have a lot to improve in a few key areas, namely:

- B2B eCommerce

- Internationalization

- Headless Commerce

- Complex Catalogs (may change with the 2000 variant limit coming)

- Multibrand / Multisite

- Enterprise DevOps

They seem to be focused on many of these areas, such as increasing Variant limits to 2000 and improving B2B functionality and Shopify Markets Pro.

We see them taking massive market share from Salesforce Commerce Cloud and putting it in a very vulnerable position.

BigCommerce

BigCommerce is arguably the number two eCommerce platform behind Shopify right now. It’s one of only two other public eCommerce platforms, Vtex, and has a larger revenue than Vtex and a much more significant North American footprint.

Being smaller than Shopify isn’t necessarily a bad thing. BigCommerce has many opportunities and advantages over competitors. It’s a true SaaS like Shopify that is easy to manage but has focused on upmarket enterprise features. They have an affordable enterprise plan, great APIs, more out-of-the-box functionality than Shopify for enterprise, and many new features.

BigCommerce has struggled to keep up with Shopify’s incredible theming capabilities, but its recent acquisition of Makeswift will be attractive to see if it can catch up there.

Their most significant improvements lately have come with their additions to B2B and multistore. They now offer multistore support like Magento but in SaaS, which Shopify can’t do. They also have developed a B2B edition and are rapidly improving their B2B offering. They recently went in depth on 100 new features!

Strengths:

- Agnostic payment options

- Flexibility

- Headless capabilities

- Multistore

- B2B Capabilities

Weaknesses / Needs Improvement:

- Theming & CMS

- App marketplace is smaller than Shopify

- Developer ecosystem (harder to find trained developers)

- Enterprise DevOps / Staging (staging pro helps, but its still not where it needs to be)

Adobe Commerce (Magento)

According to Gartner and Forester, Magento is still one of the key eCommerce platforms and is considered one of five leaders, along with Salesforce, Commerce Tools, Shopify, and SAP Hybris. However, Magento has transitioned to more of a B2B eCommerce platform or enterprise B2C platform for large and complex business-to-consumer use cases.

Many of the smaller Magento sites have moved on to Shopify or BigCommerce. Magento’s major advantage is its open-source nature, massive amounts of native functionality, B2B functionality, and overall enterprise functionality. They still have a great partner program and tons of amazing developers in the community. The community is still strong and powers Magento.

Magento is now owned by Adobe and is increasingly integrated into Adobe products and services. This has many pros, but also many cons, as a big company with many other priorities.

Strengths:

- Integrating other Adobe products

- Large enterprise customer base

- Agnostic payment options

- Flexibility

- Multistore

- B2B Capabilities

Magento is great in B2B and for larger companies, but it needs to improve in:

- Frontend development ease of use

- The learning curve for new people

- Time to market

- Cost of Ownership

- Massive range of providers that makes it hard to tell who is actually good or not anymore

The main issue we see with Adobe Commerce / Magento is that it has become too expensive and complicated for most businesses. It’s much easier to choose Shopify or BigCommerce to reduce your costs. You need to have very complex B2B needs that can take advantage of the open-source nature of the product or some other highly complex use case.

Salesforce Commerce Cloud (Formerly Demandware)

Salesforce is an ecosystem I have generally avoided in the eCommerce space. We have done more work with CRM than with its commerce platform, so you can take whatever I say with a grain of salt.

However, I have been in this business deeply for 12 years and have seen many people choose this platform as well as leave this platform. I have also had many in-depth conversations with people in this ecosystem.

Salesforce Commerce Cloud (formerly Demandware) has dominated the enterprise B2C space for roughly ten years. Magento bungled this opportunity in the early 2010s with the launch of Magento 2 and became more of a B2B play.

However, the rise of Shopify and BigCommerce has threatened Salesforce’s stranglehold on enterprise B2C clients. I believe Salesforce Commerce Cloud’s days are numbered, and we will see a mass exodus of anyone making under 100 million in sales online on the platform. A similar problem happened with SAP Hybris in the past several years.

My thesis is that Salesforce will not be able to sustain enough business here on the few mega accounts it can hold on to. That is why I see them as the most vulnerable leader spot left of the 4 I have put in my chart above. Large companies don’t change quickly, so they have time to adapt and try to keep market share, but I think this will be a losing game for them in the long run.

Strengths:

- Integrating other Salesforce products

- Large enterprise customer base

- Agnostic payment options

- Internationalization

- Merchandizing Capabilities

- Complex B2C Catalogs

Weaknesses

- Small ecosystem of talent makes it expensive to hire for

- The learning curve for new people

- Time to market

- Cost of Ownership

- The product is split between B2C and B2B, and significant rewrites are being redone, which puts the future at a considerable risk

My main concern with Salesforce Commerce Cloud is that I don’t think enough new users will adopt the platform, and they will lose more customers than they can keep. In the long term, this isn’t sustainable, and they will prioritize other investments as a massive company.

Commerce Tools

I didn’t put Commerce Tools in my leader category for one main reason. I just don’t think they have enough volume as a platform.

I am always very concerned when a platform has only a small number of enterprise clients. I find this unsustainable, and often, these platforms die out, like Oracle ATG and what’s happening with SAP Hybris and the other enterprise-only platforms.

Commerce Tools built its business on the concept of Headless / Composable. Don’t get me started on the buzzwords; to me, they are the same thing: if you are going headless, you end up needing some variation of composable architecture.

They are the leader in Composoble / Headless eCommerce platforms, boasting some huge clients. They win on deals in which the clients need something highly flexible and want the freedom of headless, which would be harder to do in theory versus non headless first platforms.

Strengths:

- Flexibility

- Headless capabilities

- Large & Complex enterprise use cases

Weaknesses / Needs Improvement:

- Limited to no app ecosystem

- Limited agency/developer ecosystem

- High complexity

- High cost of ownership

A significant risk here is that all major platforms are building around Headless, and soon, Headless First won’t be much of a selling point at all. I believe the platforms that can cover non headless use cases will have more investment to put into their overall platform and thus API, making them eventually better headless platforms.

SAP Commerce (Hybris)

SAP acquired the eCommerce platform Hybris in 2013, over 10 years ago. That is probably when this platform peaked. Since then, it is clear that not many new businesses are moving to the platform, except for large companies that are fooled into using it because they use other SAP products.

SAP Commerce still has some very large customers, and has a strong presence in the B2B space. Their strength definitely lies in B2B, and being able to sell into the SAP ecosystem, the largest ERP platform, allows them to get deeply entrenched in many large companies.

Overall, we see very few new investments in companies going to SAP Commerce, and I think they will lose more customers than they gain in the coming years.

Strengths:

- Large Enterprise Use Cases

- B2B Capabilities

Weaknesses / Needs Improvement:

- Theming & CMS

- Limited to no app ecosystem

- Limited agency/developer ecosystem

- High complexity

- High cost of ownership

Vtex

Vtex is an interesting platform and arguably one of the most underrated technologies in eCommerce. It is a public company with a very strong South American presence. They are growing fast and their earnings reports show a lot of promising signs.

Although it has not yet made a major penetration into the US and Canadian markets, there are some signs of strength there. It can handle complex headless use cases and hard use cases like marketplaces or other Omnichannel problems.

It seems to be a good fit for large and complex companies similar to Commerce Tools, but there doesn’t seem to be much of a market for small to mid-market companies using it.

Strengths:

- Payments

- Flexibility

- Headless capabilities

- Multistore

- Complex B2C Use Cases

- Fast Growing

- B2B use cases

- Marketplaces

Weaknesses / Needs Improvement:

- Weak American penetration

- Weak partner agency program for North America

- Seemingly only enterprise and expensive

Shopware

Shopware is a very interesting eCommerce platform that is generating momentum in Europe and starting to see signs of life in other regions. They have yet to have major penetration in the United States but are making headway there. Their roots are Open Source, but they have a PaaS and SaaS option so that you have flexibility in choosing.

They are focusing on the midmarket and are an interesting option for companies that want the flexibility of Open Source but are a smaller company that isn’t just merged into Adobe like Magento is now. The most significant risk I see here is whether they will be relevant in the future. Will they gain enough market share to sustain and grow to be competitive amongst many other strong eCommerce platforms?

Strengths:

- Flexibility

- Open Source Community

- Affordability

- B2B Capabilities

Weaknesses / Needs Improvement:

- Lacking North American penetration

- Risks and tradeoffs that come with Open Source, such as generally higher maintenance costs

- Not a lot of significant enterprise use cases

Kibo

Kibo is a headless first platform with a powerful OMS solution. This makes it unique because it can solve the eCommerce problem and also the more complex order management needs a business might have as one platform.

Kibo is headless first, so it’s a bit more complicated to implement than something like Shopify or the traditional platforms that don’t require additional frontend complexity. It seems like an ideal option for anyone considering a more composable approach that is looking at options like Commerce Tools and other headless first options.

The main risk we see here is similar to many other platforms on the list. Can they get enough market share to be a long-term, meaningful competitor? Frankly, I don’t think there is enough business for all of these platforms to survive long-term, so it’s a matter of which ones you are willing to bet on.

Strengths:

- Order Management

- Flexibility

- Headless capabilities

- Promotions

- B2B Capabilities

Weaknesses / Needs Improvement:

- Theming & CMS

- App Marketplace

- Developer ecosystem (harder to find trained developers)

- Relatively small amount of use cases and total customers compared to other large platforms

WooCommerce

WooCommerce is probably my least favorite platform on this list. Why? Its not really an eCommerce platform, and actually just a plugin to WordPress. WordPress is so popular that there are a lot of people using WooCommerce who simply just don’t know any better.

The advantage of WooCommerce is how easy it is to setup and get going with WordPress and the plugin. There is also a massive community around WooCommerce.

The major issue with WooCommerce is that WordPress was never designed for eCommerce and is not architected well for the complexity of orders, product management, customers, and other complex eCommerce features. You end up with a hodge podge of plugins adding to the core WooCommerce plugin and technical nightmare.

In the end you have a platform that can’t really scale very well technically and will cost you more than using something like Shopify or BigCommerce.

Strengths:

- Open Source

- WordPress Community

- Easy to get started

Weaknesses / Needs Improvement:

- Plugin conflicts

- Technical Debt

- Doesn’t scale

- Bad for anything larger and at scale

Optimizely

Optimizely is originally known as a split testing software. However, they merged with Episerver, Insite, and some other software companies. They are now an ASP.net competitor to Adobe Experience manager with a suite of tools.

My concern here is they bought two eCommerce platforms, and it’s not clear which one is going to be the future. The future of their eCommerce platform is very much a huge question mark, and I don’t see them being a heavy-weight competitor to the larger eCommerce players in the space anytime soon.

The original Insite product was good for B2B eCommerce but now that future is unclear. It may still be a viable eCommerce play for certain types of B2B use cases but I would proceed with extreme caution before buying this confusing merger of companies.

Strengths:

- CMS ecosystem

- Flexibility

- B2B Capabilities

Weaknesses / Needs Improvement:

- Unclear future

- Messy product merging

- Hard to find good agencies

- Large cost of ownership for value

HCL

I am just going to come out and say it. I have no idea why anyone would choose HCL. I think they bought up the old Oracle eCommerce assets and are some remnant of another platform. They seem to somehow boast some major enterprise customers but I can’t see why you would choose it over other enterprise players. I literally can’t name a single agency or person that talks highly about the platform…

Strengths:

- They seem to have some large enterprise customers

Weaknesses / Needs Improvement:

- The fact that no one knows the platform and I don’t see how they can possibly have a future without merging into someone else…..

Unilog

Unilog is a great product if you want a cheap and fast solution for B2B eCommerce for specific niche ERPs. Those ERPs seem to be Infor CSD (distribution) and Epicor Profit 21. They may have other integrations but those are the two main ones I know.

They handhold the process and get you up and running cheaply with decent B2B features, but I don’t think you can customize and take the site past a basic level of B2B functionality.

I would not use it if you don’t have one of their ERPs they have already built an integration for either.

Strengths:

- Cost Effective

- Handholding of product data

- Good integration to Infor CSD and Epicor

- B2B Capabilities

Weaknesses / Needs Improvement:

- No real B2C strength

- No real partner ecosystem

- Struggle with complex and unique use cases

- No real market outside a few B2B ERP markets

Elastic Path

Elastic Path is a bit of a mystery to me in that I am not sure why anyone would choose it over the many other headless options. It doesn’t seem to be as far along as Commerce Tools, Kibo, BigCommerce Catalyst, and many other headless options that are also often cheaper too. I really think they will need to merge or get bought out by a bigger competitor.

Their main advantage seems to be around B2B, flexibility, and headless, but I am not really sure how you can justify those being better than other options in the market, so I would proceed with caution here.

Strengths:

- Flexibility

- Headless capabilities

- Multistore

- B2B Capabilities

Weaknesses / Needs Improvement:

- Theming & CMS

- App marketplace

- Very little ecosystem

- Expensive

Sana Commerce

Sana Commerce is extremely focused on B2B eCommerce within the SAP and Microsoft ERP niches. They have taken a similar approach to Unilog in that it can be a great B2B tool if you use one of those ERPs that they have tightly integrated with. I think the challenge with a platform like Sana is that you both, have to use that ERP, and are going to be limited within a smaller ecosystem than a platform like Shopify, BigCommerce, or Magento. This may pose challenges when you are trying to scale and build better experiences.

Strengths:

- ERP integration to Microsoft and SAP

- B2B Capabilities

- Cost of ownership relatively low for B2B

Weaknesses / Needs Improvement:

- Theming & CMS

- App marketplace

- Developer ecosystem (harder to find trained developers)

- Not a large ecosystem of highly customized websites

Oro

Oro was built by the original technical founder of Magento, Yoav Kutner. He built Oro with the vision of a B2B focused product and without the technical debt that Magento incurred over the years.

The product and code seems great, as you would expect from a technical founder, but I fear it still has the same issue many of these other platforms have. They just don’t have a large enough community to be competitive at scale.

I suspect Oro, and many of these smaller competitors will need to merge or get acquired in the long run.

Strengths:

- Flexibility

- Headless capabilities

- Multistore

- B2B Capabilities

Weaknesses / Needs Improvement:

- Theming & CMS

- App marketplace

- Agency & developer ecosystem (harder to find trained developers)

Overall, with my bias on North America, I don’t really see any platforms making a major push for marketshare besides Shopify and BigCommerce. I think the other platforms will struggle to gain major marketshare in an environment that is increasingly competitive and cost conscious. Shopify and BigCommerce are the two most cost effective options for the majority of buyers with their SaaS offering and large ecosystems. Shopify is obviously the clear leader in this, but I think BigCommerce is makings some good strides to compete as another viable SaaS offering.

Conclusion

As we look ahead into 2024 and beyond, the eCommerce platform landscape continues to evolve with Shopify and BigCommerce at the forefront. While Shopify maintains its lead by continuously enhancing its features and expanding its global reach, BigCommerce is not far behind, particularly in addressing enterprise needs and B2B functionality. Each platform is uniquely positioned to cater to specific business requirements, from headless commerce to internationalization. As companies navigate their digital transformation journeys, selecting the right platform becomes crucial to leverage the strengths and mitigate the challenges highlighted in this overview. The choice between Shopify and BigCommerce, or exploring other emerging platforms, should align with strategic business objectives and operational demands.

If you need help selecting the right platform for your business, contact Trellis for comprehensive guidance on what best fits your requirements.

Leave a Comment